How ROFR Laws Increase Electric Transmission Costs in Midwestern States

March 7, 2023

By Josiah Neely

This report was originally published by R Street Institute, a member of ETCC, and can be viewed here.

In 2011, the Federal Energy Regulatory Commission (FERC) issued Order 1000, which introduced the possibility of competition into the electric transmission system. Prior to Order 1000, when the operator of a regional transmission organization (RTO) determined that a new transmission project was needed, they would assign the right to build and own that project to the incumbent utility in whose service territory the project would be built. This was known as a “right of first refusal” (ROFR). Order 1000 removed all federal ROFR requirements, and created a new process in which RTOs used a competitive bidding process to select who should build and own the project in appropriate cases. However, while Order 1000 eliminated the federal ROFR requirement, it permitted states to enact their own ROFR laws. If a state chose to enact its own ROFR, RTOs would defer to this and not use competitive bidding when dealing with transmission projects in that state.

The 12 years following the issuance of Order 1000 have seen a divergence among states with respect to ROFR. Some states have instituted their own ROFR requirements, while others have rejected them. Utilities in non-ROFR states continue to push for them, while consumer advocates, free market groups and some environmental advocates are opposed. Opponents of ROFR make the reasonable point that eliminating competition will raise costs to consumers. Without the pressure of competition, utilities will have less incentive to keep project costs low. The best research supports this view, suggesting that competition results in a 20-30 percent cost savings for transmission projects.

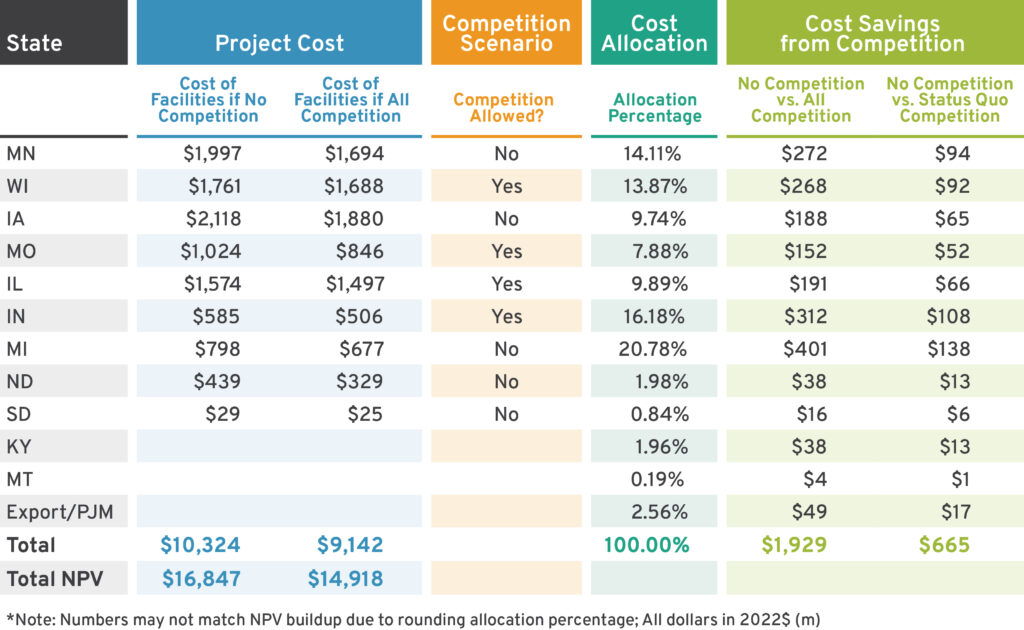

But what does this mean for individual states that may be considering their own ROFR laws? To shed some light on this question, we looked at a set of recently approved projects in the Midcontinent Independent System Operator (MISO)’s RTO. The northern half of MISO’s geographic footprint is centered in the Midwest, and includes all or part of North and South Dakota, Minnesota, Iowa, Missouri, Wisconsin, Illinois, Michigan and Indiana. MISO is roughly split between ROFR and non-ROFR states. Currently, both Dakotas, Minnesota, Iowa and Michigan have ROFR requirements prohibiting competition, while Missouri, Wisconsin, Illinois and Indiana either have no ROFR or have one that only applies to small projects.

MISO is currently embarking on major transmission expansion. Last year MISO’s board approved the first of several “tranches” of new transmission projects, with a group of projects expected to cost over $10 billion. Further tranches are anticipated to be larger, and the total in project costs could be as much as $100 billion.

Even absent state ROFR laws, not all of this $10 billion would be eligible for competition. MISO’s rules permit competition only for new greenfield projects, which require new lines in new locations, as opposed to so-called brownfield projects, which involve upgrades or expansions of existing lines and facilities. We have estimated that approximately $4.7 billion of Tranche 1 projects are greenfield. Assuming a 25 percent cost savings for these projects, full competition would save Midwesterners $1.9 billion for Tranche 1 projects alone, on a 40-year net present value basis. But current state ROFR laws reduce this customer savings to $665 million, meaning current state ROFRs cost consumers over $1.25 billion. Looking at where these projects are going to be built, we can also get a sense of how individual state ROFR laws affect the total cost. Repealing the Minnesota ROFR law alone would increase customer savings by an additional $495 million across MISO states, raising the total savings to over $1.1 billion. By contrast, adding a ROFR requirement in Missouri would increase project costs by $290 million, cutting the already diminished cost savings from competition nearly in half again.

An interesting wrinkle in all this is that while a state’s ROFR requirement increases the costs of projects built in that state, not all of those additional costs are borne by ratepayers in that state. This is because the costs of a project are often divided up between multiple states in cases where the project will benefit more than one state. This means that if a state ROFR law makes transmission projects in that state unnecessarily expensive, it is not just electricity customers in that state who will bear the burden. Residents of other states—who are not a part of the ROFR state’s electorate—will pay some of the higher cost as well.

The situation is roughly analogous to when a group of people goes out to dinner and agrees to split the bill. If one member of the group orders lobster and top-shelf scotch to go with his meal, his portion of the bill will be higher—but so will the portions of everyone else who just ordered the Tuesday Special. By contrast, if someone decides to be frugal and forego dessert, this will lower his bill, but not by as much as if everyone were getting separate checks.

The states that currently allow competition—Missouri, Wisconsin, Illinois and Indiana—will pay $100 million, $175 million, $125 million and $205 million more, respectively, for Tranche 1 projects because of other states’ existing ROFR. For example, Wisconsin would save $268 million from full competition in the MISO footprint, but only realizes $92 million in competition savings due to other states’ ROFRs that reduce competition. Wisconsin’s savings would rise to $161 million if Minnesota repealed its ROFR law.

This is the first time that the harm of one state’s ROFR on other states has been quantified. Our analysis demonstrates clear interstate burdens and discrimination, which may increase the odds of litigation success against state ROFRs. It also makes a more compelling argument for the Federal Electricity Regulatory Commission to preempt state ROFRs, and may accelerate the Department of Justice’s notable concern on the matter. It further informs state leaders and constituents how much they are paying for other states’ anti-competitive policies, which may further motivate states to seek relief in the courts, from federal regulators or engage their peers in regional forums to drive the need for a competitive consensus on transmission.